Life Insurance for Retirement: Discovering the Insured Retirement Program (IRP)

(Eight-minute read time)

The journey to financial security requires careful consideration of various investment and savings options, especially when planning for retirement and managing your estate. In Ontario, the Insured Retirement Program (IRP) Line of Credit is a tool that can enhance retirement income while providing life insurance benefits. But how do you determine if it's the right strategy for your financial portfolio?

This article will guide you through the essentials of the IRP in Ontario, unpack its advantages, identify who it's most suitable for, discuss its role in estate planning, and compare it with other retirement options like TFSAs, RRSPs, and pensions. We'll also discuss the drawbacks and walk through a scenario to help you see the IRP in action. Plus don’t forget to download our IRP cheat sheet at the end of the article.

Whether you're a seasoned investor or exploring retirement solutions for the first time, understanding the IRP is crucial to making an informed decision that aligns with your long-term financial goals.

To Learn More About Life Insurance, Check Out Our Other Articles:

What Type of Life Insurance is Best?

Term vs Whole Life Insurance in Ontario

Am I Too Young For Life Insurance?

Getting Approved for Life Insurance in Ontario - What You Need to Know

What is the Insured Retirement Program (IRP) in Ontario?

The Insured Retirement Program (IRP) is designed for individuals who want to maximize their retirement savings while also ensuring they have a comprehensive life insurance policy in place. At its core, an IRP involves taking out a permanent life insurance policy, such as whole life or universal life insurance. These types of policies not only provide a death benefit to protect your loved ones but also accumulate a cash value over time. This cash value grows within the policy, often on a tax-deferred basis, making it an attractive component for long-term financial planning.

Insured Retirement Program (IRP) Line of Credit

An Insured Retirement Program (IRP) Line of Credit lets you borrow money using your life insurance policy as security. This means you can get cash now and, when you pass away, whatever you borrowed (plus any interest you owe) gets paid off from the insurance money before the rest goes to your loved ones, tax-free.

Additionally, you don't have to worry about monthly payments for the interest. Instead, the interest just gets added to the amount you owe. This way, you can use the money you need today without the stress of immediate repayments.

Who Is the Insured Retirement Program (IRP) For?

Insured Retirement Program (IRP) is best for people who:

Are Age 50 or older — regardless of your retirement status

Already purchased or can qualify for permanent life insurance

Are financially stable with disposable income (to pay premiums on life insurance policy)

Wish to obtain estate planning benefits

Are committed to long-term financial planning (since the benefits of IRP are greater over many years)

Have maxed out other tax-advantaged accounts (like RRSPs and TFSAs) and wish to seek more tax-efficient savings and additional sources of retirement income

For those younger than 50, buying permanent life insurance now can give your policy more time to accumulate value for when you retire later.

Pros and Cons of the Insured Retirement Program (IRP)

Pros:

Retirement Income Potential: Once you retire, the IRP allows you to access the cash value of your life insurance policy as a source of income. This can be done through policy loans or withdrawals, depending on the policy's terms and conditions. The strategic use of these funds can supplement your retirement income, helping to cover living expenses, leisure activities, or unexpected costs.

Flexibility and Control: An IRP offers flexibility in terms of how much you invest, when you access the funds, and how you use the retirement income generated. It provides a way to control a significant part of your financial future, with the added security of life insurance protection.

Tax-Free Benefits: When you use an IRP Line of Credit, you're not actually taking money out of your policy, so you don't trigger any taxes. After you pass away, whatever amount is left from your insurance after paying off the loan and interest goes to your loved ones without any tax.

Investment Growth: By assigning your life insurance policy as security for an IRP Line of Credit, you get cash to use now without interrupting the tax-free growth of the cash value inside your insurance policy.

Convenience: With an IRP Line of Credit, you take out only what you need when you need it. Accessing your cash is easy – whether through cheques, ATMs, direct payments, online, or on your phone. Plus, you only pay interest on what you actually owe at any time.

Cons:

Upfront Cashflow: Permanent life insurance policies, such as those used in IRPs, typically have higher premiums than term life insurance policies. The cost can be a significant consideration for individuals weighing the benefits of an IRP.

Complexity: IRPs involve a combination of life insurance and investment strategies, which can be complex to manage and understand. It requires careful planning and, often, professional advice to navigate effectively.

Loan Repayment: While borrowing against the policy's cash value can provide tax-free income, it also reduces the death benefit if the loan plus interest is not repaid. This could impact the financial legacy left to beneficiaries.

Long-Term Commitment: An IRP is typically most effective as a long-term strategy. Early withdrawal or surrender of the policy can result in high fees and potential tax implications.

Borrow to Boost Your Retirement Income

To learn more, check out our latest article: 4 Reasons Why You Should Get a Home Equity Line of Credit (HELOC) Before Retirement

Insured Retirement Program’s (IRP’s) Role In Estate Planning

The Insured Retirement Program (IRP) not only serves as a method for accumulating retirement income but also plays a pivotal role in estate planning. Here's an expanded look at how it integrates into a comprehensive legacy strategy:

Tax-Free Death Benefit: A cornerstone of the IRP's value in estate planning is the life insurance policy's death benefit, which is paid out tax-free to your beneficiaries upon your passing. This immediate liquidity can be crucial for covering estate taxes, final expenses, or any outstanding debts, ensuring your estate's assets can be passed on to your heirs without being diminished by taxes or creditors.

Bypass Probate: In many cases, the death benefit from a life insurance policy can bypass the probate process when beneficiaries are named directly on the policy. This means your beneficiaries can access funds more quickly and without the costs associated with probate, providing timely financial support when it's most needed.

Equalization of Inheritance: An IRP can be used to provide equal inheritance to multiple beneficiaries. For example, if one child is designated to inherit a family business or property, the death benefit from the IRP can be allocated to other children, ensuring a fair distribution of assets.

Preserving Estate Value: By using the tax-free death benefit to cover potential estate taxes and debts, the IRP helps preserve the value of your estate for your heirs. This is particularly beneficial for larger estates or those with significant illiquid assets, like real estate or business interests.

Funding Charitable Gifts: The IRP can also be used to leave a charitable legacy. By naming a charity as a beneficiary of the life insurance policy, you can make a significant tax-free donation upon your death, reflecting your values and contributing to a cause you care about.

Flexibility and Control: The IRP offers flexibility in estate planning, allowing you to adjust beneficiaries and the coverage amount as your financial situation and goals evolve. This control is essential in legacy planning, ensuring that your estate plan remains aligned with your wishes.

Providing for Special Needs Dependents: If you have dependents with special needs, the IRP can ensure they receive financial support without jeopardizing their eligibility for government benefits. A properly structured death benefit can provide for their care and quality of life in your absence.

The Insured Retirement Program (IRP) enhances retirement income and contributes to effective estate planning — it offers a way to secure your retirement and protect your loved ones beyond your lifetime.

We Offer Free Consultations

Let us help you discover which life insurance is best for you

You information is confidential and is not shared with any other party, including insurance companies.

Comparing Insured Retirement Program (IRP) With RRSPs, TFSAs, and Pension Plans

When considering retirement savings options in Ontario, it's important to understand how an Insured Retirement Program (IRP) compares to other popular investment strategies like RRSPs (Registered Retirement Savings Plans), TFSAs (Tax-Free Savings Accounts), and pension plans. Each option has its unique features, benefits, and considerations:

-

Life Insurance Benefits: Offers a death benefit in addition to acting as a retirement savings vehicle, providing dual benefits.

Tax-Deferred Growth: The cash value within the policy grows tax-deferred.

Loan Feature: Allows for tax-effective access to funds through policy loans, without mandatory repayment schedules, though loans can reduce the death benefit.

No Contribution Limits: Unlike RRSPs and TFSAs, there are no annual contribution limits, but premiums must be managed to keep the policy in force.

-

Tax-Deferred Growth: Like IRPs, RRSPs offer tax-deferred growth, allowing investments to grow without being taxed until withdrawal.

Tax Deduction: Contributions to an RRSP are tax-deductible, reducing your taxable income for the year.

Withdrawal Tax: Money withdrawn from an RRSP is taxed as income at your marginal rate.

Contribution Limits: There are annual contribution limits based on your income. Additionally, after retirement, you can no longer contribute to your RRSP.

Retirement Focus: Primarily used for retirement savings, with penalties for early withdrawal, except for specific programs like the Home Buyers' Plan.

-

Tax-Free Withdrawal: Unlike IRPs, TFSAs offer tax-free growth and withdrawal, providing flexibility in accessing funds without tax implications.

No Tax Deduction: Contributions to a TFSA are not tax-deductible.

Contribution Limits: There are annual contribution limits, but unused contribution room can be carried forward.

Versatility: Can be used for various savings goals, not just retirement, with no penalty for withdrawal at any time.

-

Employer-Sponsored: Pension plans are typically offered by employers and can be a defined benefit (promising a specific payout at retirement) or defined contribution (depending on the contribution and investment performance).

Tax-Deferred: Contributions and growth within the plan are tax-deferred.

Fixed Retirement Income: Especially in defined benefit plans, they provide a predictable income in retirement.

Limited Control: Investment choices and contributions are often determined by the plan, offering less flexibility than IRPs, RRSPs, or TFSAs.

In summary:

TFSAs offer tax-free growth and withdrawal, making them highly flexible for both short-term and long-term savings. RRSPs and IRPs offer tax-deferred growth, but RRSP withdrawals are taxable.

TFSAs provide the most flexibility for withdrawals, while IRPs and pension plans offer benefits tied to specific purposes (retirement income and life insurance for IRPs, retirement income for pension plans).

IRPs and pension plans can provide structured long-term benefits, with IRPs offering the unique advantage of a life insurance component.

Choosing the right mix of these options depends on individual financial situations, goals, and needs. It often benefits individuals to have a diversified approach, incorporating elements of each to achieve a balanced and secure financial plan for retirement.

To learn more about TFSA’s and RRSP’s, check out our article: How to Effectively Use Your TFSA and RRSP

Consider This Scenario: Direct Investment or IRP?

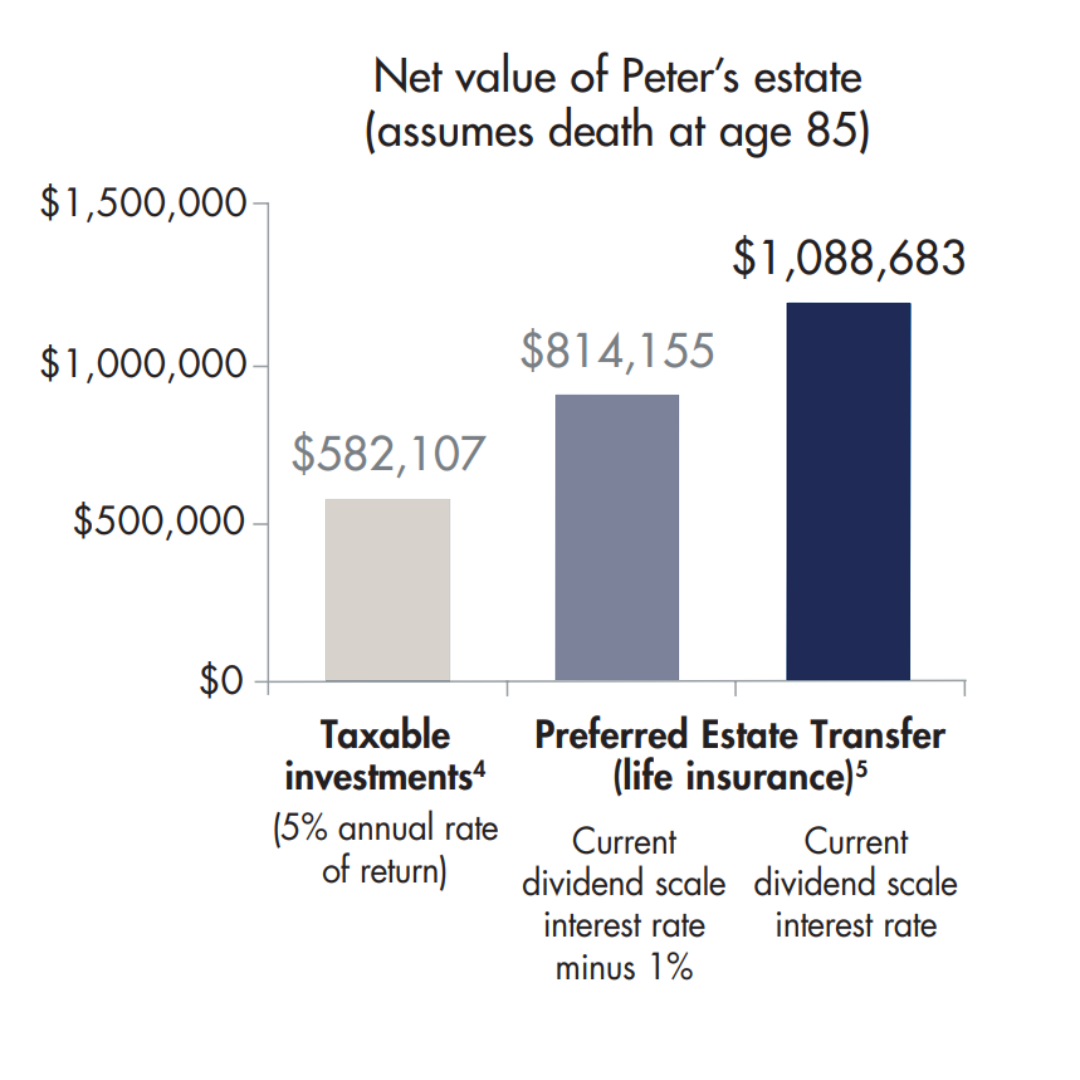

Peter is 51 years old and is looking for a tax-efficient way to build value in his estate and increase the legacy he can leave for his loved ones. He can afford to spend $25,000 annually for the next 10 years.

Peter is considering two options:

Option 1 - Direct Investment: He could invest the $25,000 into traditional taxable investments each year, which would grow over time and be subject to taxes.

Option 2 - IRP Approach: Redirect the same $25,000 yearly into an Insured Retirement Program (IRP) using a permanent life insurance policy. This strategy, often referred to as a Preferred Estate Transfer within the context of IRPs, allows the cash value within his life insurance policy to grow, often tax-deferred, and can provide a tax-efficient death benefit to his heirs.

Using life insurance, Peter can create a larger net worth than with taxable investments, with a much more reliable return.

When we compare the two options, the IRP strategy has the potential to yield a higher net estate value for Peter at the age of 85, assuming typical investment growth and insurance dividend scales. The difference between the two options is $506,576, almost double!

Additionally, the tax advantages inherent in the life insurance policy, along with the compounded growth of the policy's cash value, may result in a more substantial legacy than if Peter had chosen the route of taxable investments.

By selecting the IRP, Peter is not only preparing a significant tax-free benefit for his loved ones but also ensuring that his annual contributions work efficiently within a tax-advantaged environment.

Conclusion

The Insured Retirement Program (IRP) is a strategic approach to retirement planning, offering a blend of life insurance protection and the potential for supplemental retirement income. From providing tax-efficient benefits to playing a pivotal role in estate planning, the IRP can be an attractive option for certain individuals in Ontario.

By carefully weighing the benefits against the potential risks and consulting with your financial advisor, you can make a choice that not only meets your current needs but also paves the way for a secure and prosperous future.

If you would like to learn more about the Insured Retirement Program (IRP), download our cheat sheet about how you can put the Insured Retirement Program (IRP) to work for you. Plus you’ll access an additional scenario to help you visualize how IRP can transform your retirement planning strategy.

FAQ About the Insured Retirement Program (IRP)

-

The Insured Retirement Program (IRP) is a financial strategy in Ontario that combines life insurance with a line of credit feature, allowing individuals to enhance their retirement income while benefiting from life insurance coverage.

-

You invest in a permanent life insurance policy that builds cash value over time. Later in life, you can borrow against this cash value through a line of credit to supplement your retirement income, while the death benefit remains intact to provide for your beneficiaries.

-

The IRP is ideal for individuals who are financially stable with disposable income (to pay premiums on life insurance policy), have maximized their RRSP and TFSA contributions, and are looking for additional tax-effective ways to save for retirement.

-

RRSPs offer tax-deferred growth and tax-deductible contributions but come with annual contribution limits and are taxed upon withdrawal. In contrast, IRPs also provide tax-deferred growth without contribution limits, include a life insurance benefit, and allow tax-effective access to funds through policy loans that do not require mandatory repayment, though they can reduce the death benefit.

The choice between an IRP and an RRSP depends on your financial goals, needs, and situation. RRSPs are ideal for straightforward retirement savings with immediate tax benefits, while IRPs offer a combination of life insurance protection and retirement savings, suitable for those seeking a more flexible and multifaceted approach. Often, incorporating both strategies in a diversified retirement plan can provide a more balanced and secure financial outlook.

-

Advantages of the Insured Retirement Program (IRP) include the potential for tax-advantaged income during retirement, the security of a life insurance benefit for estate planning, and the flexibility to access funds without selling assets.

Drawbacks of the Insured Retirement Program (IRP) might include the complexity of the product, higher insurance costs compared to term life insurance, and potential risks if the policy's investment performance doesn't meet expectations.

-

The Insured Retirement Program (IRP) adds a stable, tax-advantaged component to your investment portfolio by allowing you to invest in a life insurance policy that grows cash value. This cash can later be borrowed tax-free, providing a reliable source of funds in retirement without impacting your tax bracket. This makes the IRP especially valuable for high-net-worth individuals looking for liquidity along with tax efficiency in their retirement planning, complementing more volatile investments by providing financial stability.

-

Yes, the death benefit from the life insurance can be used to provide a tax-free inheritance to beneficiaries, cover estate taxes, or fulfill other final expenses, making it a versatile tool for estate planning.

-

Consider your current financial situation, your retirement goals, and your family’s needs. It’s also wise to consult with a financial advisor to thoroughly understand the IRP’s implications for your overall financial strategy.

Recognized By

Interested in Learning More About Life Insurance?

Check out our additional resources: