Real Estate Investing Guide for Realtors

(Eight-minute read time)

Navigating your personal investment landscape as a realtor in Ontario requires insight and strategy. This article considers the nuances of real estate as an investment opportunity for realtors, considering the benefits, downsides, and partnerships with other realtors. In the end, we hope to help you make informed decisions that align with your personal financial goals. Let's explore how your industry knowledge can benefit your own investment portfolio.

Want to Learn More About Investing in Real Estate?

Check out our additional videos:

4 Ways that Real Estate Investing Makes Money in Ontario

Downsides of Investing in Real Estate in Ontario

Student Rental Financing Tips and Traps for Ontario

How to Build Wealth with Real Estate in Ontario (2022 Seminar Replay)

Why Invest In Real Estate?

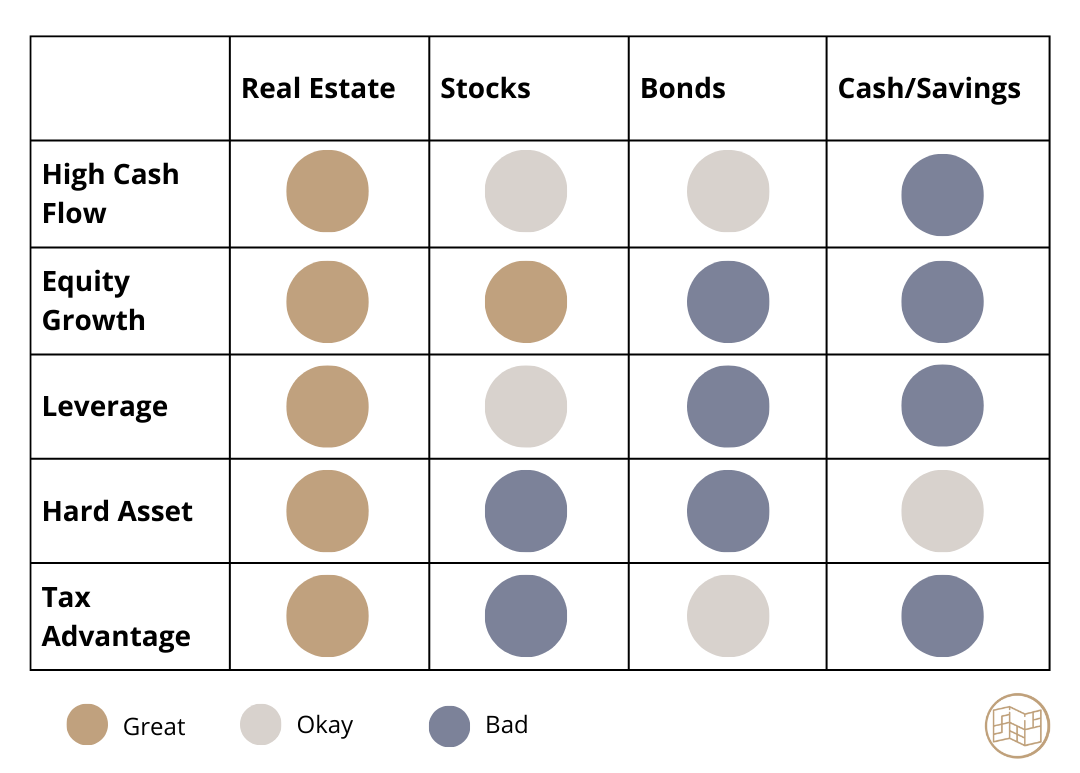

Investing in real estate offers unique benefits compared to other investment vehicles, making it an appealing option for many, including real estate agents looking to diversify their portfolios.

High Cash Flow: One of the primary advantages of real estate investments is the potential for generating a stable cash flow. This is achieved through rental income, which can provide a steady stream of money each month. The buy-and-hold strategy, where investors purchase properties to rent out, is a common approach. This method generates monthly income and allows for capital appreciation over time as property values increase.

Equity Growth: Real estate is a tangible asset known for appreciating over time. This appreciation, combined with the equity created from renters paying down the mortgage, offers dual benefits. Each rent payment contributes to reducing the principal amount owed, effectively having someone else contribute to your investment's growth.

Leverage: Real estate investments allow for significant leverage, a powerful tool for investors. By using a mortgage, investors can control a large asset for a fraction of its total cost. Typically, real estate investments can be leveraged at a ratio of 5:1, meaning for every dollar of your own money, you can control five dollars of real estate. This amplifies potential returns far beyond what is possible with a margin account for stocks, where the typical leverage might be 2:1.

Hard Asset: Since real estate is tangible, it is a hard asset. You can see, touch, and utilize the property. For many, this tangibility adds a level of security and comfort compared to stocks or bonds. Properties can be improved, repurposed, or lived in, adding to their value in ways not applicable to other investment types.

Tax Advantages: Real estate investing comes with considerable tax benefits, particularly when compared to non-registered investments. With real estate investments, real estate appreciation is taxed favourably as a capital gain. This means you'll pay approximately half of the tax you'd pay on similar income. In addition, taxes on the appreciation are deferred until the property is sold. This deferral allows the investor to preserve cash for other opportunities while their real estate appreciates without an immediate tax bill.

Overall, investing in real estate can offer steady cash flow, substantial equity growth, leverage opportunities, the security of a tangible asset, and a tax advantage. These factors combined make real estate an attractive long-term investment as part of your overall portfolio.

Borrow, Build, Preserve

Learn more about how WealthTrack helps investors.

Four Ways to Profit in Real Estate

Cash Flow: This refers to the income generated from rental properties after all expenses have been paid. It's the profit left over each month or year, providing investors with a steady stream of income.

Mortgage Pay Down / Principal Recapture: Each time you make a mortgage payment on a property, a portion goes toward reducing the principal amount of the loan. Over time, this increases your equity in the property without requiring additional investment from you.

Forced Appreciation: This involves increasing the value of a property through active efforts like renovations, upgrades, or improving its operational efficiency. Unlike passive appreciation, it's directly under the investor's control.

Passive Appreciation: This is the increase in the property's value over time due to external factors, such as market conditions or inflation, without any direct effort from the investor.

Tip for New Investors: be prepared to pay income tax each year for the income generated as cash flow PLUS the amount that your mortgage principal was paid down. Mortgage principal paid down is considered profit and taxed as income.

Benefits of Investing in Real Estate for Realtors

For realtors, investing in real estate goes beyond the general benefits available to average investors. Thanks to your profession, you possess a unique set of advantages that can make real estate investment especially rewarding.

Market Insight and Connections: Your day-to-day operations immerse you in the property market, giving you a high level of insight. You’re the first to know about market trends, property values, and emerging areas poised for growth. This information can guide your investment decisions, allowing you to spot opportunities that others may miss.

Access to Listings and Deals: Your profession provides you early or exclusive access to listings and potential deals. This can be a significant advantage, enabling you to act quickly on promising investments before they become widely known. Your network may also bring off-market deals to your attention.

Negotiation Skills and Transaction Experience: Your negotiating skills and familiarity with real estate transactions can lead to better deals and more favorable terms. This can mean lower purchase prices, better financing rates, or more advantageous contract terms, directly benefiting your investment bottom line.

Operational Advantages: Your knowledge of the legal, financial, and procedural aspects of real estate transactions reduces the likelihood of encountering costly mistakes or oversights. This expertise can streamline the investment process, from acquisition to management and eventual sale.

Personal Brand and Reputation: Your personal brand and reputation can open doors and build trust with sellers, buyers, and tenants. A strong reputation in the community can lead to better deals and a more profitable investment portfolio.

The combination of market insight, access to deals, and professional experience sets you apart from the typical investor, enabling more informed decisions and greater potential for success.

Downsides of Investing in Real Estate for Realtors

Investing in real estate, while often lucrative, presents several challenges, especially for realtors. Here are some downsides to consider:

Tenant Issues: As a real estate investor, you're not always in control of your tenants' behavior or financial reliability. You might face situations where tenants stop paying rent or cause significant damage to the property. High tenant turnover can add to this challenge, requiring frequent searches for new tenants, each of whom brings their own set of risks.

Time Intensive: The demands on your time can be unpredictable and can distract you from your real estate business.

Maintenance and Management Costs: Real estate requires constant upkeep and maintenance to preserve its value and ensure tenant satisfaction. While hiring property managers can alleviate this burden, their services come at a cost, which can eat into your profits.

Variable Expenses: In Ontario, as a real estate owner, you may face unpredictable hikes in property taxes and maintenance costs. Rent increases are subject to provincial regulations, which might not always align with rising expenses, leading to scenarios where your rental income doesn't cover your increasing costs.

Long-term Tenants: While having stable, long-term tenants can be positive, it can also become a drawback if rental market prices rise significantly. If your tenants are unable or unwilling to move, you may find yourself unable to adjust rent to match market rates, impacting your income.

Tax Implications: After years of appreciation, you will face a tax bill for the gains made in the value of the property, whether you sell at market value or pass it down to your kids. This can result in capital gains tax in the hundreds of thousands of dollars.

Realtor-specific Risks: Fluctuating and unpredictable income can make qualifying for mortgages challenging. Additionally, entering into partnerships for real estate investments carries its own set of risks, including disagreements and financial disparities.

While real estate can offer significant benefits, it also involves challenges such as tenant management, rising costs, tax implications, and specific risks related to the nature of a realtor's income. These factors should be carefully considered before diving into real estate investment.

Considering Buying Investment Property for Student Rentals?

Uncover student rental financial tips and traps by reading our article: Getting a Mortgage and Buying an Investment Property for Student Rentals

Real Estate Partnerships With Other Realtors

Forming real estate partnerships among other realtors offers unique investment opportunities but requires financial and legal planning to mitigate inherent risks. Here are some points to consider:

Joint Investments Between Realtors: When you decide to partner with another realtor in an investment property, the division of debt and income must be carefully considered. Even if you divide ownership, financial institutions view each realtor as fully responsible for the debt. This division impacts qualifying for future personal mortgages due to perceived higher debt levels.

Mortgage and Ownership Complications: If you and your realtor partner share a property and only you take on a mortgage, it could create an imbalance. As the first realtor, you face increased debt, affecting your ability to secure loans, while the second realtor, your partner, is potentially not on the title and might appear less indebted, which can skew financial risk and benefits.

Holding Companies: You might think about setting up a holding company (holdco) to reduce your tax liabilities. Although this approach offers some advantages, it's important to understand that the tax implications are often similar to personal ownership. Moreover, purchasing properties through a holdco could lead to higher mortgage rates.

Personal Risk: Owning real estate with another realtor is a business partnership with high stakes, you must take steps to manage that risk because there are many things out of your control. Personal events like divorce, death, financial troubles, or changes to your partner’s goals could jeopardize the partnership. These risks highlight the importance of clear agreements and financial risk management (insurance).

Exit Strategies and Insurance: Establishing an exit strategy is crucial. Be honest with yourself and your partner about your plans and don’t ignore the fact that all good things must come to an end. Implement a buy-sell agreement, and have life insurance policies in place for each partner to ensure that the surviving partner can buy out the deceased’s share, providing a smooth transition and protecting all partners and their families in the event of tragedy.

The Importance of Planning and Risk Management: Before partnering with another realtor, you must plan meticulously, considering all scenarios, including the death of a partner, which can lead to significant tax liabilities. Joint tenancy arrangements and adequate life insurance (e.g., policies on each other to cover capital gains taxes and buyout agreements) can mitigate risks.

Want to Improve Your Financial Strategy as a Realtor?

Check out our additional articles, tailored just for you:

How Life Insurance Can Protect and Grow Realtors’ Financial Future

Is Investing In Real Estate Right for You?

Real Estate Investment Readiness Checklist:

Maximize RRSP and TFSA contributions.

Evaluate property management skills and availability.

Have a robust financial safety net.

Assess time commitment for real estate management.

Review risk tolerance and investment goals.

Before diving into real estate, examine your existing investment strategies. Are your RRSP and TFSA maxed out? These accounts offer tax advantages that must be considered before exploring additional investment avenues.

Real estate investing is not just about finances; it requires time and effort. Consider whether you have the skills to manage property maintenance or the means to hire professionals. Time is a critical factor — managing a property can be time-consuming, from tenant issues to regular maintenance.

Do you have a solid financial safety net? Unexpected expenses, such as emergency repairs or vacant periods without rental income, can impact your finances. Ensure you have sufficient reserves to cover these unforeseen costs without jeopardizing your financial stability.

If you're new to investing or if real estate seems too daunting, starting with lower-risk investments like TFSAs may be a better approach. These can offer a good return with less hands-on management and lower risk compared to direct real estate investments.

Real estate investing can be lucrative but it's not for everyone. It requires a thorough assessment of your current financial situation, personal skills, available time, and your risk tolerance. If you find yourself well-prepared and equipped, it could be a valuable addition to your investment portfolio. Otherwise, consider building your financial foundation with other investment vehicles first.

As much as we love real estate, it is not a liquid investment. You need to be realistic about your time horizon and plan for your eventual exit. You should not rely on your real estate to quickly turn back into cash at a moments notice, so you need to have a back up plan.

Conclusion

By carefully evaluating your personal and financial situation, understanding the intricacies of real estate partnerships, and assessing whether real estate investment aligns with your goals, you can make a more informed decision. Remember, the best investment strategy is one that aligns with your financial goals, risk tolerance, and personal preferences.

If you believe investing in real estate is right for you and want to craft your investment strategy with professional guidance, book a free call with us today.

Recognized By

Interested in Learning More About Investing?

Check out our additional resources: